LEDGERS Accounting Software

LEDGERS accounting software with GST invoicing, GST software and GST eWay bill integration.

RS.2200

GET STARTED

GST E-way bill

What is the GST E-way Bill?

E way bill is short for Electronic Way Bill. GST E-way bill is a document used to track goods in transit introduced under the Goods and Service Tax. A taxable person registered under GST involved in the transportation of goods with a value of over Rs.50,000 must possess an E-way bill generated on the GST Portal.

LEDGERS has made E-way bill generation and management very simple for business. The Ledgers E-way bill tool is synced to GST invoices, bills of supply, purchases invoices, and customer or supplier accounts.

E-E-Way Bill can be generated seamlessly at the click of a button and shared with the customers or suppliers. The procedure for moving the movements of goods is prescribed in the E-way bill rules. However, it is to be noted that when the GST Act came into being on the 1st of July, the E-way bill implementation was deferred.

Documents to generate E-way Bill

What documents are required to generate an E-way bill?

- Invoice/ Bill of supply/ Challan relevant to the consignment of goods

- In case of Transport by road- Transporter ID or the vehicle number

- Transport by rail, air, or ship- Transporter ID, Transport document number, and date.

Format of GST E-way bill?

The E-way bill consists of two parts Part A and B. The Part A of the E-way boll collects the details related to consignment, usually the invoice details. Accordingly, the following information needs to be submitted.

- GSTIN of the recipient must be submitted.

- The Pin code of the place where goods are delivered needs to be mentioned.

- The invoice or the challan number against which the goods are supplied must be submitted.

- The value of consignment is to be mentioned.

- HSN code of the goods which are transported should be entered. If the turnover is up to INR 5 crores, the HSN code’s first two digits should be mentioned. If the turnover is more than INR 5 crores, a four-digit HSN code is required.

- The reason for transportation should be predefined, and the most appropriate one needs to be selected.

- The transport document number should be indicated. It includes goods receipt number, railway receipt number, airway bill number.

Who should generate an E-way bill?

The following cases wherein a person having GST registration are causing goods movement should generate an E-way bill.

- E-Way bill generation is done when there is a movement of goods of more than Rs.50,000 value to or from a registered person. The registered person can even generate an E-way bill if the goods’ valuation is less than Rs.50,000.

- An unregistered person is also required to generate an E-way bill. When an unregistered person makes a supply to a registered person, the receiver must ensure that all the compliances are complied with.

- A transporter carrying goods via road, air, rail, etc., is required to generate an E-way bill if the supplier has not generated any E-way Bill.

How to Generate E-Way Bill

An E-Way Bill (EWB) is an ‘electronic way’ bill for movement of goods which can be generated on the E-Way Bill Portal. Any supplier or a transporter transporting goods with a value of more than Rs.50,000 (Single Invoice/bill/delivery challan) in a single vehicle should carry a GST e-way bill as per the GST Council regulations. The supplier or the transporter of the goods must register with GST to obtain GST E-Way bill. This bill shall come into effect from 1st April 2018.

After generating the E-Way bill on the portal using required credentials, the portal generates a unique E-Way Bill Number (EBN) and allocates to the registered supplier, recipient, and the transporter. In this article, we look at the steps to generate a e-way bill on the Government website.

The supplier or the transporter can create the E-way bill through the following ways:

- LEDGERS Software,

- E-Way bill portal

- SMS,

- Android App and through,

- Site-to-Site Integration (through API).

Steps to Generate E-Way Bill through Website

E-way bill can be generated on the GST E-Way Portal. To use the portal, you will need a GST registration and transporter registration.

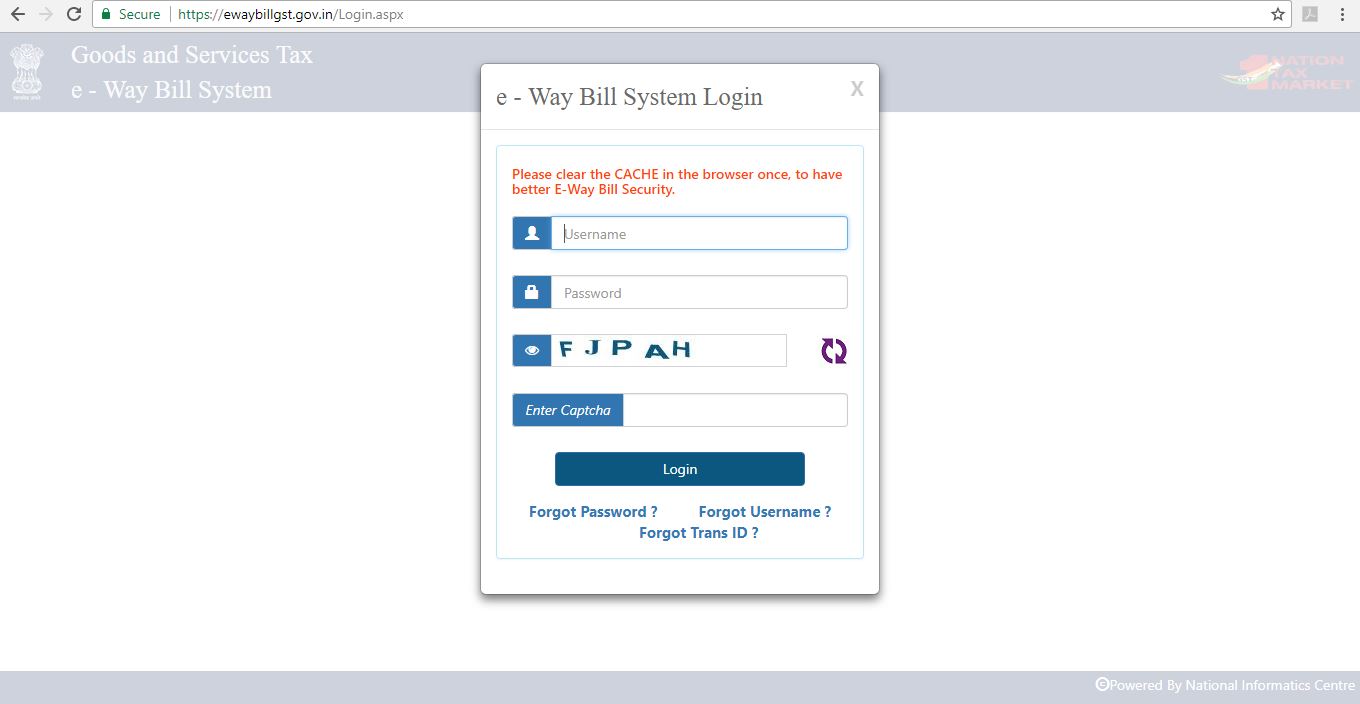

Setp 1: Access the E-Way bill generation portal at https://ewaybill.nic.in/ and enter the login detail to enter the platform.

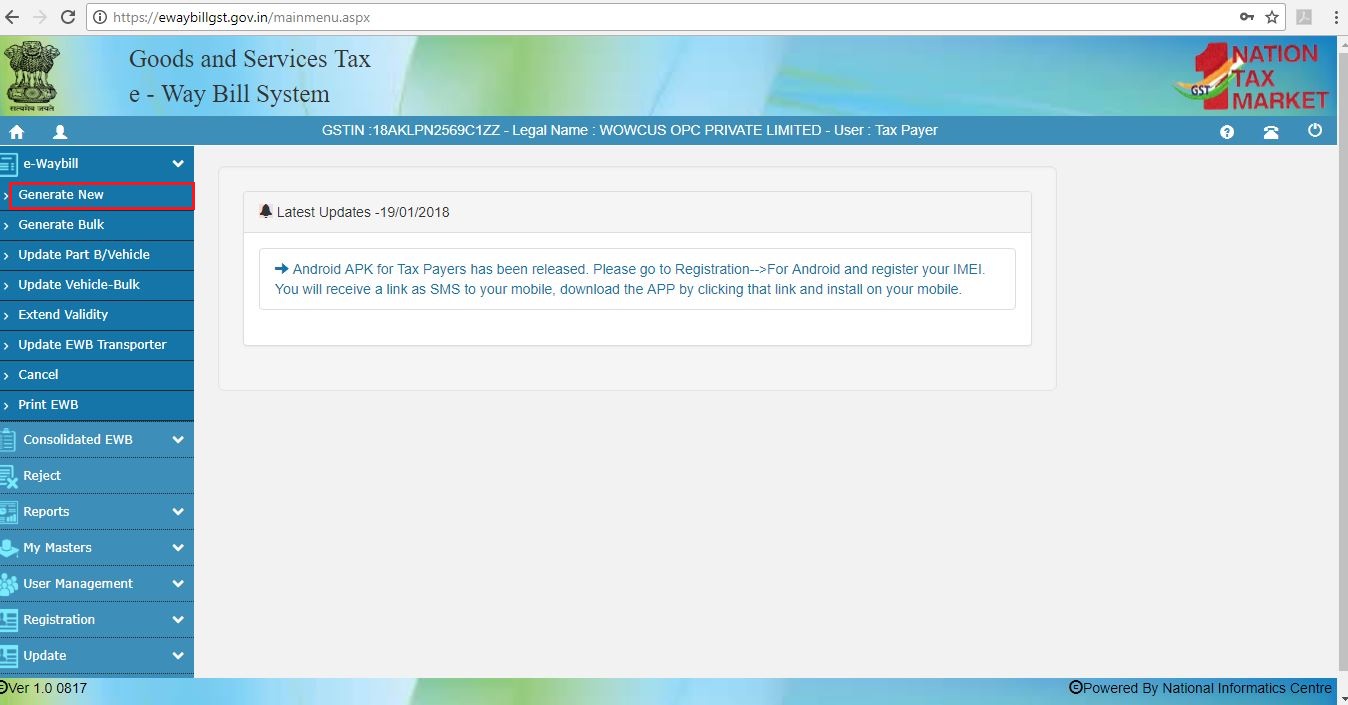

Setp 2: Click on the “Generate New” option from the E-Way bill- Main menu page to create a new E-Way bill.

Generate E-Way Bill

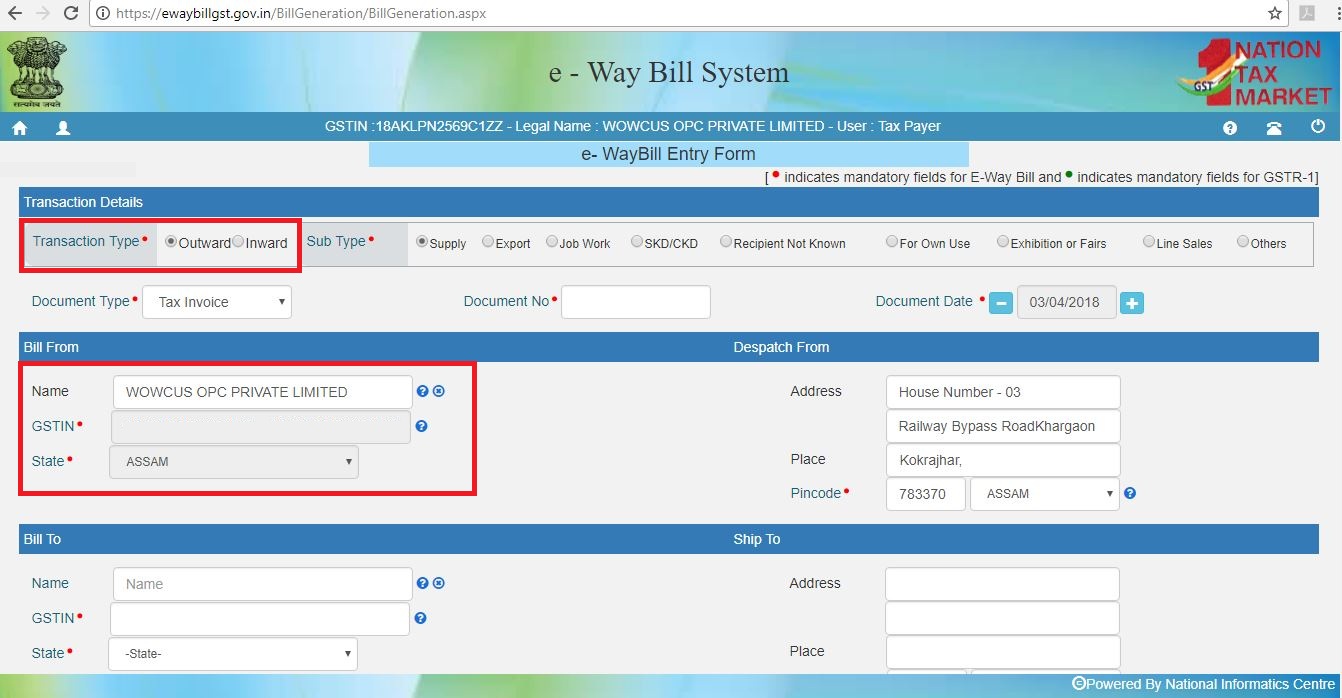

Setp 3: A new EWB bill generation form appears. Fill in the details required similar to creating a GST invoice.

Select outward, if you are the supplier and inward, if you are the recipient. Enter details of the supplier and recipient along with GSTIN, wherever applicable.

When a registered GSTIN is entered in the field provided in the form, other details gets pulled into the empty fields. Before proceeding to the next step kindly check the details.

Enter Goods Description

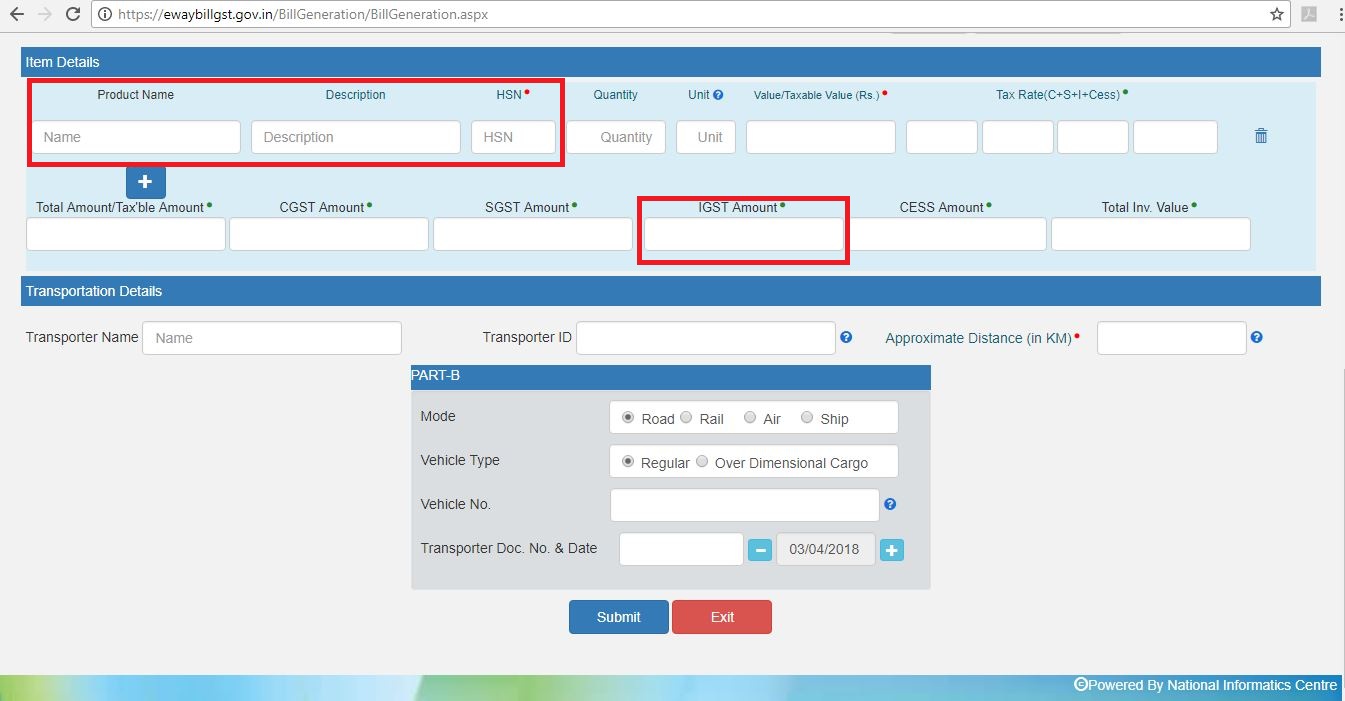

Setp 4: The second half of the page will contain information to be filled as follows:

- Product Name and Description must be completed similar to a tax invoice.

- HSN Code for the Product must be entered. Click here to find HSN code.

- Quantity and Unit of the goods.

- Value of the products along with Tax rate.

- IGST or CGST Rates applicable. IGST would be applicable for inter-state transport and SGST / CGST for intra-state transport.

- Approximate distance of transport along with Transporter Name and Transporter ID. This shall determine the validity of the E-Way bill.

Setp 5: Generate E-way bill

After filling all the necessary details, click on the “SUBMIT” button to create the EWB. The Portal shall display the E-Way bill containing the E-Way Bill number and the QR Code that contains all the details in the digital format. The printed copy of the bill should be provided to the transporter who will carry it throughout the trip till it is being handed over to the consignee.

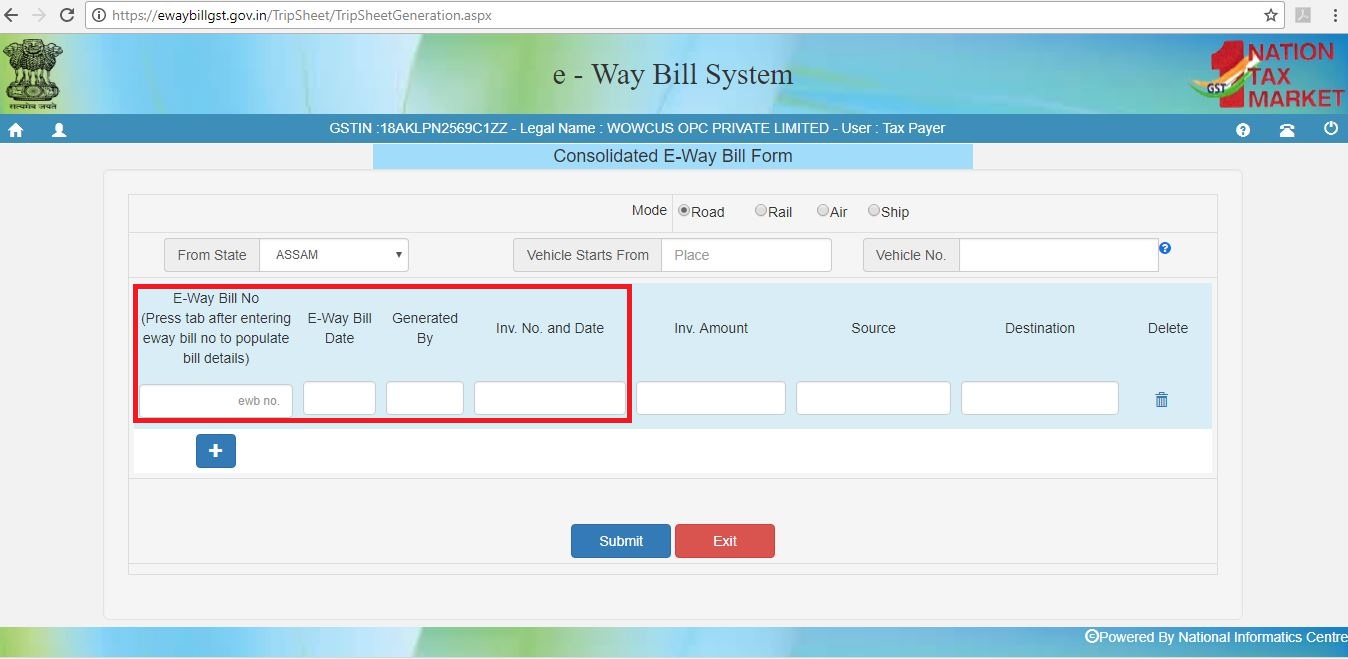

Setp 6: Consolidate E-way Bill Generation

A consolidated EWB can also be created which contains all the details on the transaction and is also easy to create it by providing just the ‘E-Way bill number’ in the required field. Click on “SUBMIT” to generate the consolidated EWB.

An E-Way bill can be updated once it is created. Details on the transporter, consignment, consignor and also the GSTIN of both the parties can be updated in the existing E-Way bill provided the bill is not due on its validity.

The validity of the eWay Bill

What is the minimum distance required for E-way bill?

The significant amendment made effective video notification no. 12/2018- Central tax dated 7th March 2018 changes in the validity period of E-way bill. The new validity period provisions of the E-way bill are tabulated here:

| Type of Conveyance | Distance | E-way bill |

|---|---|---|

| Other than Over dimensional cargo | Less than 100 km | 1 day |

| For every additional 100 km and thereof | Additional 1 day | |

| For Over dimensional cargo | Up to 20 km | 1 day |

| For every additional 20 km and thereof | Additional 1 day |

The relevant date on which the E-way bill has been generated and the period of validity would be counted from the time at which the E-way bill has been generated, and each day would be counted as the period expiring at midnight of the day immediately following the date of generation of the E-way bill.

‘Over Dimensional Cargo’ is a cargo carried as a single indivisible unit and which exceeds the dimensional limits prescribed in rule 93 of the Central Motor Vehicle Rules,1989, made under the Motor Vehicles Act,1988 (59 of 1988).

SMS E-way Bill Operation

SMS e-way bill generation is ideal for entities with limited transactions, as it would be prudent to use other methods in case of higher volume.

SMS e-way bill generation facility can also be used by taxpayers in case of emergencies such as during the night or while involved in travelling in a vehicle.

Enabling SMS E-Way Bill Facility

Before starting to transact, the taxpayer must first register his/her mobile number on the GST e-way bill portal. The system only enables and responds to mobile number registered on the portal for a particular GSTIN.

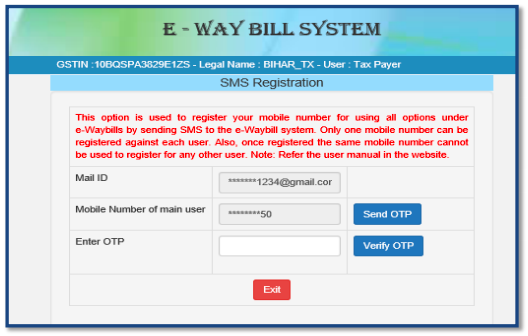

Once user selects option ‘for SMS’ under main option ‘Registration’, following screen is displayed.

The user must enter the mobile number and complete the OTP to register the mobile number.

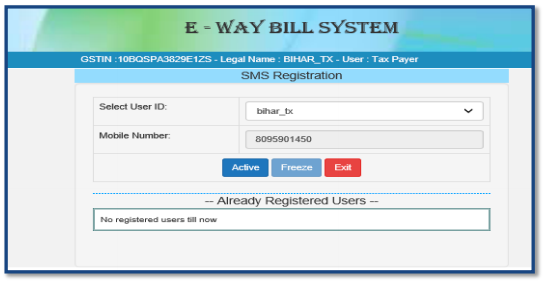

In the next screen the mobile number registered with the GSTIN is displayed. The user can use this screen for delinking or changing the mobile number, if required.

Step 1: Access to Portal

The taxpayer or the transporter must open the e-way bill portal and log in using his/her credentials.

Step 1: Register Mobile Number

Enable the SMS e-way bill facility by following the below shown above. Once validation is complete and the mobile number is registered, you are ready to generate e-way bill using SMS.

Who does not need a GST E-way bill?

-

1 When the below-mentioned goods are being transported E-way bill is not required :

- Liquefied petroleum gas for supply to household and non-domestic exempted category (NDEC) customers;

- Kerosene oil sold under PDS;

- Postal baggage transported by Department of Posts;

- Natural or cultured pearls and precious or semi-precious stones; precious metals and metals clad with precious metal (Chapter 71);

- Jewelry, goldsmiths and silversmiths wares and other articles (Chapter 71);

- Currency;

- Used personal and household effects;

- Coral, unworked (0508) and worked coral (9601)

-

2 In case of Transport of goods from customs port, airport, air cargo complex, and land customs station to an inland container depot or a container freight station for clearance by Customs, E-way bill is not required.

-

3 When a non-motorized conveyance is transporting goods, E-way bill generation is not required.

-

4 When following goods are being transported, the e-way bill is not required to be generated;

- Alcoholic liquor for human consumption

- Petroleum crude

- High-speed diesel

- Motor spirit (commonly known as petrol)

- Natural gas,

- Aviation turbine fuel

- When there is no supply as per provisions in Schedule III of the Act, an E-way bill is not required.

-

5 E-way bill is not required to be generated when the goods are being transported—

- Under customs bond from an inland container depot or a container freight station to a customs port, airport, air cargo complex, and land customs station, or one customs station or customs port to another customs station or customs port, or

- Under customs supervision or customs seal;

- Where the goods being transported are transit cargo from or to Nepal or Bhutan;

- Where the goods being transported are exempt from tax under various notifications;

- When Central Government, State Government, or a local authority acting as a consignor undertakes the Transport of goods by rail, no E-way bill is required.

- When goods movement has been caused by defense formation under the Ministry of defense as consignor or consignee, no E-way bill is required.

- No E-way bill is required in case of Transport of empty cargo containers.

- In case goods are being transported for weighing purposes and the distance is not more than 20 Kms from the place of the consignor’s business to the weighbridge or vice versa, E-way bill generation is not required. However, the movement of goods must be accompanied by a delivery challan.

- When goods specified in the schedule appended to notification no, 2/2017-Central Tax (Rate) dated 28.06.2017 is being transported, other than de-oiled cake, then in such case, e-way Bill is not required to be generated.